Have you ever looked at your business accounting and wondered…

Is this correct? Am I doing this right? Should I be doing more?

Many business owners ask themselves these questions. You are a business owner not an accountant, so it’s no surprise if you don’t know exactly what bookkeeping and accounting tasks your business needs.

But whether you like it or not, managing numbers is a big part of managing a business. You need to have accounting systems in place to run a successful and healthy company.

If you aren’t sure what you need, here are some guidelines to ensure that your business has the level of bookkeeping and accounting needed to grow, survive, and thrive.

What Type of Accounting Does My Business Need?

To get an idea of the level of accounting your business needs, consider your annual revenue. Looking at the size of your business can give you an idea of what type of accounting tasks you should be doing and how often you should be working in your books.

Keep in mind that this isn’t a clear-cut threshold. One dollar over annual revenue might not bump up needs, and a small company may need more support if they operate with a lot of financial transactions.

If you’d like to know exactly what your unique business needs, talk to a professional. Our team is happy to talk through your needs during a free discovery call. Schedule your free call with our team today.

Less Than $120k in Annual Revenue

No business is too small for basic bookkeeping. Any business generating income should keep detailed records of financial transactions on a cash basis (which records revenue and expenses when they are received or paid).

While some small businesses can use spreadsheets to track income and expenses, professional accounting software is recommended for even the most basic small business. We recommend QuickBooks Online for any business generating revenue as it makes it much easier to create financial reporting needed for managing cash flow and creating reports at tax time.

Bookkeeping and accounting tasks at this level include:

- Tracking income and sales (on a cash basis)

- Tracking expenses and receipts

- Annual business tax preparation

At this level, a business should execute monthly or weekly bookkeeping tasks to keep records up-to-date and accurate. Most business owners at this level can get by managing the bookkeeping tasks on their own without professional support, but they should consider hiring a professional to prepare their tax returns.

Related: When Should You Hire an Accountant for Taxes? 6 Signs It’s Time.

$120k – $900k in Annual Revenue

Once a business begins bringing in over $120,000/year, it is time to upgrade accounting practices to enhanced bookkeeping. At this level of revenue, businesses will have a larger volume of income and expense transactions that need to be tracked in accounting software. Reliable accounting software is a must at this level.

Business transitions need to be entered every day as opposed to weekly or monthly. The business will rely more heavily on accurate reporting and data generated through accounting systems so they can make informed financial decisions.

Bookkeeping and accounting tasks at this level include:

- Tracking earned income and sales (entering customer invoices and transactions daily)

- Tracking vendor bills and bill payments

- Entering expenses as incurred on a daily basis

- Annual budgeting

- Comparing budget to actual reporting

- Tax planning

- Annual business tax preparation

At this revenue point, a business should bring on part-time bookkeeping support.

$900k – $2.4M in Annual Revenue

$900k – $2.4M in Annual Revenue

When a business begins closing in on $1 million in annual revenue, it’s time to upgrade accounting systems again. At this point, you must begin to use GAAP or Generally Accepted Accounting Principles.

GAAP is a set of accounting standards that help businesses report their operating results in a clear, concise, and consistent manner. GAAP allows for comparability of financial results between companies, which is essential for organizations that want to eventually sell or go public. Banks, investors, venture capitalists, creditors, and securities analysts will all want to see financial records that align with GAAP best practices.

Bookkeeping and accounting tasks at this level include:

- Recording accruals for income and expenses to reflect business transactions

- Customer invoicing

- Tracking vendor bills and bill payments

- Prepaid expense recognition and accounting

- Annual budgeting

- Comparing budget to actual reporting

- Cash flow management

- Forecasting financial results

- Tracking assets and depreciation

- Tax planning

- Annual business tax preparation

At this level, a business could benefit from outsourced bookkeeping paired with fractional CFO services. A fractional CFO can provide more accurate reporting, oversight, and strategic financial guidance.

Related: Navigate Business Growth: 6 Factors That Require Your Full Attention

Over $2.4M in Annual Revenue

When a business reaches over $2.4 million in annual revenue, it needs accounting at the highest level as transactions become more numerous and complex. At this point, the business should already be using GAAP and executing the tasks listed for businesses over $900k in annual revenue. The business needs both a sophisticated accounting system and a team for support.

At this stage, a business will benefit from having a full-time internal accountant or controller along with a fractional CFO and team of bookkeepers.

Is It Time To Level Up Your Accounting Systems?

As mentioned above, one dollar won’t necessarily move your business into a new category of needs, but one new large client or a quick influx in business can.

Always be looking ahead when it comes to your business accounting needs. Be ready to move to the next level before you need to.

The best way to prepare your business for leveling up your accounting needs is working with a partner who can scale with your business. Work with an outsourced team that can start small and then scale as your business and needs grow.

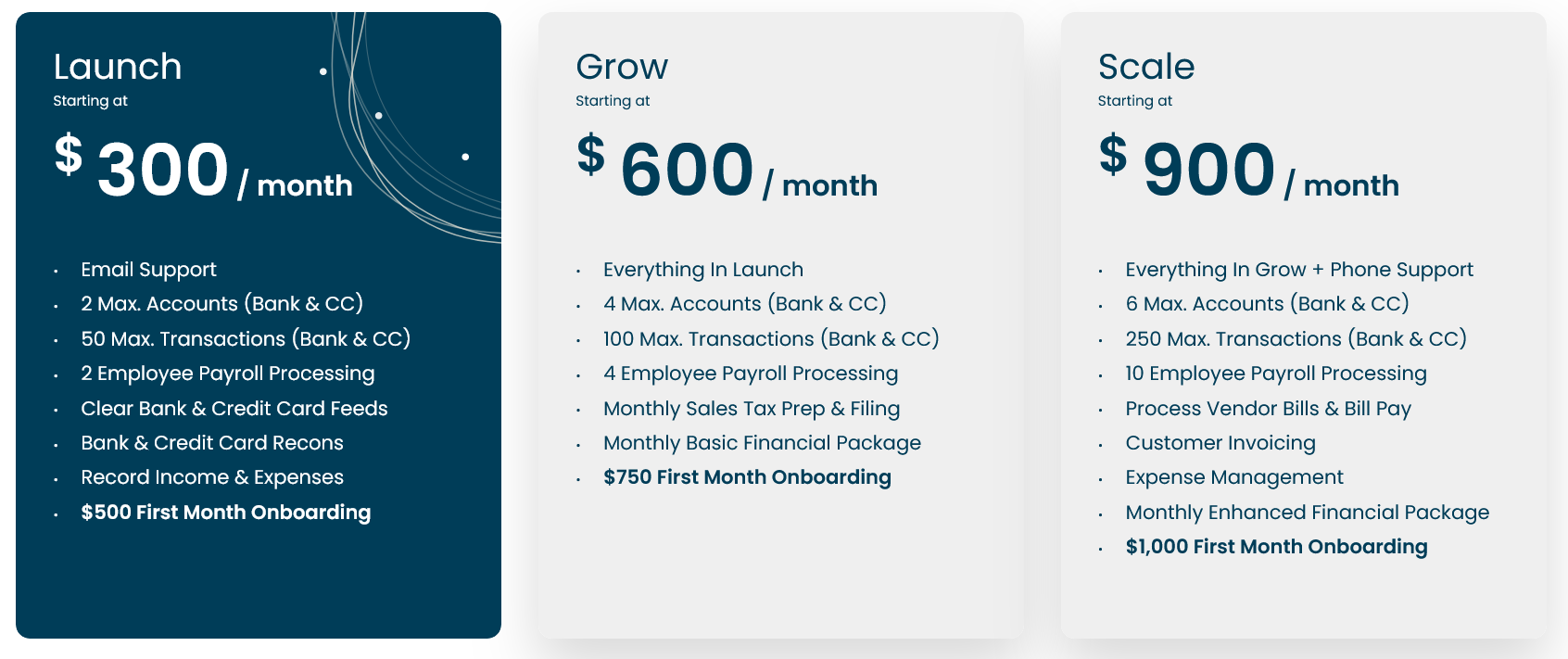

At CFO2U, we offer scalable bookkeeping packages that provide what you need now while preparing you for what you need in the future. You can start small and move up as your needs change.

CFO2U also grows alongside your business as you need higher-level financial advice and expertise. Once you outgrow simple bookkeeping, we also offer fractional CFO services and provide tax preparation services so you can get all of your business accounting needs managed by one team.

CFO2U also grows alongside your business as you need higher-level financial advice and expertise. Once you outgrow simple bookkeeping, we also offer fractional CFO services and provide tax preparation services so you can get all of your business accounting needs managed by one team.

Your business will require different levels of financial accounting and bookkeeping as it grows and evolves. Get prepared, and get what you need by working with CFO2U.

We are accounting professionals, so you don’t need to be. Talk to us about how we can create a custom monthly support plan for your business. Schedule a free call with our team today.

- Which Tax Classification Is Right For Your Small Business? - June 3, 2025

- 6 Expensive QuickBooks Mistakes You Might Be Making - April 27, 2025

- You Started a Business. Here’s What You Need to Know About Taxes - February 28, 2025