Essential financial metrics help you answer important questions about your business.

- Is your company doing well?

- Are you as profitable as you could be?

- Are your sales growing as you expected?

- Do you have enough cash at the end of the day to pay your bills and still have some left over to save for a rainy day?

It will be difficult to answer any of those questions if you don’t have the right data.

To get a full look at your business, you need to know the essential financial metrics that tell the story.

To help you get a better look at your business, let’s review the essential financial metrics that every business owner must know and review some tips for how to improve those numbers to boost the financial health of your business.

#1) Sales and Revenue

Any business owner knows that the business cannot exist without sales. Instinctively you know when sales are good and when sales are bad. To not only survive, but thrive, you need more than just what your gut instinct tells you. You need to know what your actual sales and revenue numbers are.

Sales and revenue are generally the same but, depending on your industry, they may be significantly differently. Think of total sales as the total dollar amount of goods and services that you sold to customers for the day/month/year reduced by any customer returns.

If you deliver these goods and services to your customer at the point of sale this would also be your revenue for the day/month/year. If you deliver your goods or services over time, as in the construction industry for example, your total sales would represent the dollar amount of deals closed for the day/month/year (i.e. 10 deals closed this month for a total value of $1,000,000), but your revenue would be based on the number of jobs you completed that month (i.e. 4 jobs complete for a total value of $450,000).

Track your sales first. Know how much you sold and what you sold to each customer on at least a monthly basis. This will be a leading indicator of how much revenue you’ve earned.

Then, understand:

- How much your customer returns are

- What products are being returned most often

- How often you are experiencing returns and the reasons for the returns

Improvements in customer service delivery and product quality can have a direct impact on reducing returns and increasing sales and revenue.

#2) Gross Profit

As important as sales are to your business, gross profit is more important.

Gross profit is the amount of profit that you are realizing on each sale.

Gross profit is simply your sales price less your cost of goods sold. If you sell your main product for $50 each and it costs you $25 to buy the product from your supplier, your gross profit would be $25. You would therefore have a 50% gross profit margin ($25 gross profit/$50 sales price). Whether this is strong or weak will depend on what is typical for your industry.

The key is to know how much it is costing you to purchase your products from your suppliers or deliver your service to your customers. Once you understand your costs you will be in a much better position to set your prices structure.

Imagine, unknown to you, your primary product cost you $75 to purchase from your supplier yet you were selling it for $50. You would be losing $25 every time you sold this product! What impact would this knowledge have on your business?

Want to increase your gross profit? Increase your sales prices or reduce your cost of goods sold. If increasing prices is not feasible, consider looking for suppliers that can provide you with the same or very similar product at a reduced price.

#3) Net Profit/Loss

The profit we are talking about here is the “bottom line” — the result we get after we take our gross profit and subtract all your operating costs.

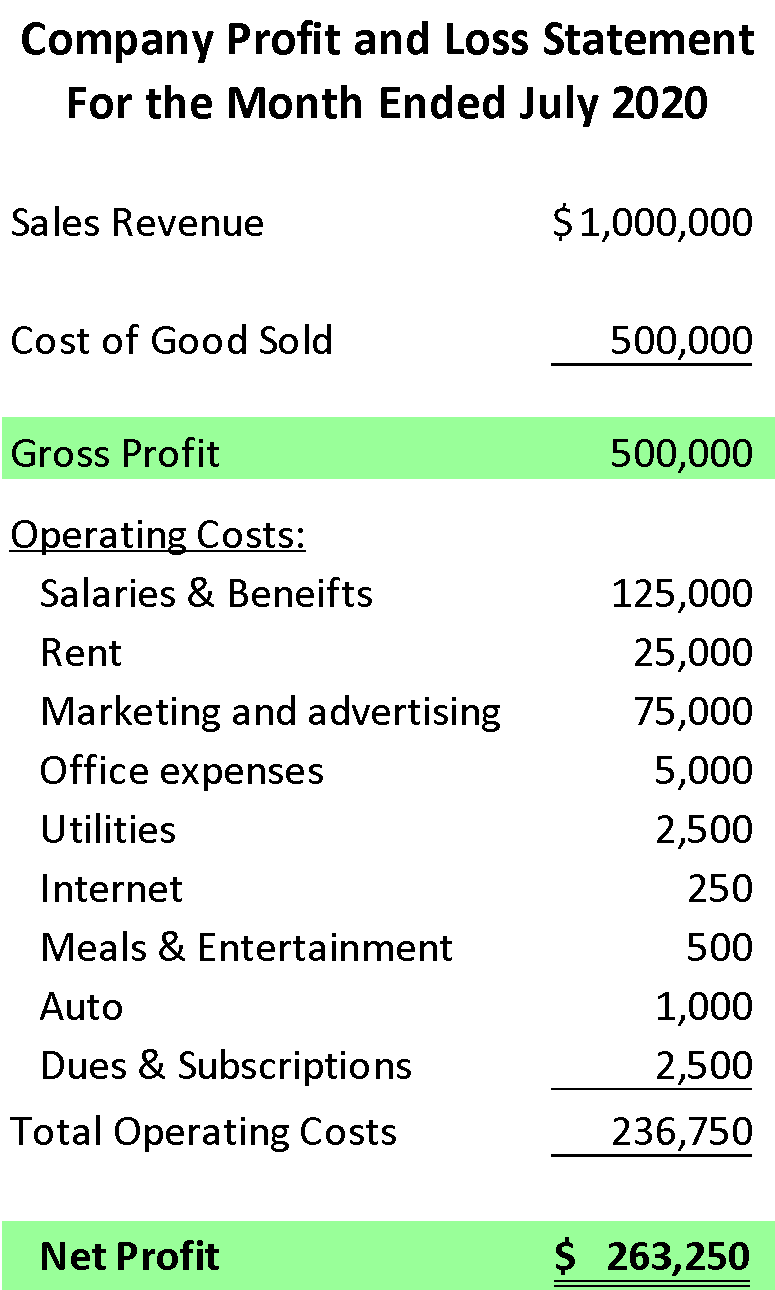

Your operating costs are your costs to open the doors and turn the light on (rent, utilities, internet, staff salaries, office supplies, etc.). Your net profit statement may look something like this:

Need to increase your net profit or turn a net loss into a net profit? Look at your cost of operations. There may be costs that you are incurring that may not be necessary that you could reduce or eliminate.

#4) Customer Acquisition Costs

How much does it cost you to gain a new customer? Tough question, you say. Without having your numbers together, this question would be impossible to answer. Let’s break it down then.

The first thing you need to know is, how much you are spending on acquiring customers.

This would include marketing and advertising costs as well as sales salaries and commissions. Next, you would need to determine how many new customers you gained during the time period you are looking at. I find it easiest to look at a month or quarter. The key here is going to be knowing when you gain a new customer so that you can determine how much it cost to gain that new customer. You may consider keeping track of your customers on a database or list and include the first date that they became a customer.

Once you get your total number of new customers acquired for the month, you could divide your total marketing, advertising, and sales expenses by the number of new customers to get your customer acquisition cost.

Tracking your customer acquisition costs over time will provide you with the insight you need to determine the effectiveness of your sales and marketing efforts. As you grow and as your brand is more recognizable you should expect your customer acquisition costs to decline.

#5) Break-even

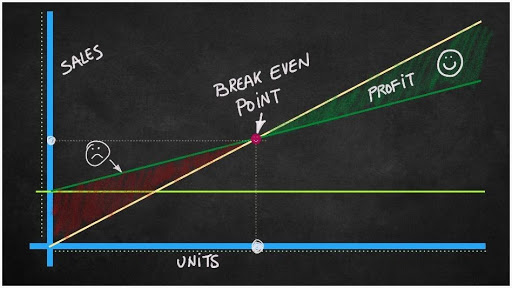

How much do you need to sell to break-even (not incur a loss or make a profit)? Your break-even point will tell you how much you need to sell to cover your fixed costs.

Once you cover your fixed costs you are on your way to profitability. This will require you to know and understand your fixed costs first and then marry it to your gross profit.

By way of example, if your fixed costs are $236,750 and you realize a gross profit of $25 on each product you sell, you would need to sell 9,470 products ($236,750/$25) to break even. Every product sold beyond this point drops to the bottom line and increases your total profit.

#6) Cash Flow

Nothing is more important to small business than cash flow. As they say, “Cash is King!”

Without cash, you could very soon be out of business. To calculate your cash flow, first determine the total cash generated by your business. This will mainly come from sales to your customers, but it could also come from loans, either from you as the owner made to the business and/or loans you receive from banks.

Next, figure out how much your business is using in cash. You will need to look at payments to vendors, employees and for business expenses. Tracking your cash flows is one of the most important metrics you will want to track.

Know not only how much cash your business is generating and using, but understanding the timing is critical. If you need to wait 30 – 45 days for your customers to pay you but need to pay your vendors on receipt, you may find yourself short on cash.

Cash management is one of the most critical tasks that a business owner does and can be one of the most stressful. It is what often keeps business owners up at night.

Need to improve cash flow? Consider accepting credit cards and requesting payment up-front from customers. You may also want to work with vendors and request to pay them 30 days after their invoice date. The closer you can match payment to your vendor with payment from your customer, the better your cash flow picture will look.

Need Help Identifying Essential Financial Metrics for Your Business?

If you went through this list and realized that you don’t know theses essential financial metrics for your business, don’t worry. CFO2U is here to help.

See how our team of professional bookkeepers can set you up for success. Schedule your discovery call to learn more.

- Which Tax Classification Is Right For Your Small Business? - June 3, 2025

- 6 Expensive QuickBooks Mistakes You Might Be Making - April 27, 2025

- You Started a Business. Here’s What You Need to Know About Taxes - February 28, 2025