We made it to the final stop! Is it time to actually recognize revenue now? Well, let’s see. What does it actually take to be able to recognize revenue?

How Do You Recognize Revenue?

Simply put — satisfy your performance obligation(s).

That’s what it takes. What,” you ask, “does that mean?” Well, let’s look at what it means; let’s break it down.

Back at our second stop, we looked at what our performance obligations were and found that they represented what we’ve agreed to provide our customer in exchange for the contract price or sales price. Our performance obligation(s) could be as simple as handing over a pair of jeans that we’ve agreed to sell to our customer in exchange for their payment or as complex as delivering a software license with an annual maintenance agreement along with installing the software on the customer’s server.

Now, when do we recognize revenue?

Our guidance, ASC 606, “Revenue from Contracts with Customers,” tells us that we “recognize revenue when (or as) the performance obligation is satisfied.” “How do we know when we’ve satisfied our performance obligation?” you ask. When the customer has taken control of the good that we’ve sold or been provided the service we’ve promised, we have satisfied our performance obligation; completed our part of the deal. At this point in time we can recognize revenue.

Let’s take the example we looked at during our fourth stop a step further.

In that example, you developed a software product and you license it to companies in the automotive industry. Your new customer is purchasing the software license, annual maintenance agreement, and 100 hours of implementation services for a total contract value of $75,000.

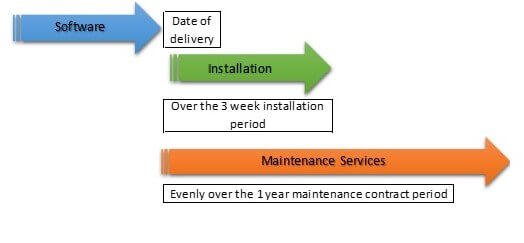

Based upon the relative standalone selling price of each of these deliverables we allocated $44,118 of the total contract value to the software license, $22,059 to the installation services and $8,823 to the one-year annual maintenance services.

Now the question is, when do we recognize revenue for each of these items? That depends on when each item is delivered to the customer and when the customer takes control of them.

Let’s say that you deliver, via secure electronic file transfer, the software license to the customer upon contract signing and payment of 50% of the contract price. The installation services are scheduled to occur immediately after contract signing and will take approximately three weeks to complete.

The one-year maintenance agreement begins immediately after the software license has been delivered. One thing that we need to figure out is do we deliver our goods and/or services at a point in time (once), or over time (as we complete work we deliver it to the customer or as we deliver our goods/services over time and the customer uses them as they are delivered).

Our recognition of revenue would look something like this:

This post is not intended to be all encompassing, but to just give you an idea of some of the complexities you may encounter in recognizing revenue for your company.

This post is not intended to be all encompassing, but to just give you an idea of some of the complexities you may encounter in recognizing revenue for your company.

As you can imagine, the effects of this new regulation can have a significant impact on your financial results, so I highly recommend that you seek out expert advice if you are in doubt or have complex customer arrangements.

This ends our journey down the revenue recognition highway. Thank you so much for joining me!

If you’d like to lay out what the road to revenue looks like for your specific business, let’s talk. Contact me to schedule your free finance one-on-one consultation.

- Which Tax Classification Is Right For Your Small Business? - June 3, 2025

- 6 Expensive QuickBooks Mistakes You Might Be Making - April 27, 2025

- You Started a Business. Here’s What You Need to Know About Taxes - February 28, 2025