IMPORTANT UPDATE (3/2/25)

We’re keeping up with quickly changing Beneficial Ownership Information (BOI) requirements. On March 2, 2025, the Treasury Department announced that it would “not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines.”

But things could still change. You can still file BOI information, or you can continue to follow along to see if changes impact your requirement to file.

Business owners are approaching an important deadline. Most businesses operating in the United States are required to submit Beneficial Ownership Information (BOI) by the end of 2024.

Use this guide to learn everything you need to know about Beneficial Ownership Information and how to file to avoid costly civil and criminal penalties.

What Is the Corporate Transparency Act (CTA)?

In 2021, Congress passed the Corporate Transparency Act. The law aims to curb illicit financial activity, such as tax fraud, money laundering, and financing for terrorism, by making the owners of U.S. businesses more transparent. The BOI is a requirement under CTA.

What Is Beneficial Ownership Information?

The CTA includes a requirement for businesses that meet specific criteria to file Beneficial Ownership Information. BOI reports the beneficial owners of U.S. companies to the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

Who Is a Beneficial Owner?

A beneficial owner is any individual who owns and/or controls a company. It is anyone who:

- Has major influence on the company’s decisions or operations

- Owns at least 25% of the company’s shares

- Owns at least 25% of the company’s equity

A company may have more than one beneficial owner. Each company is required to list each beneficial owner.

What Companies Need to File?

Most companies in the U.S. need to file BOI, but there are some exceptions. Your company needs to report information about its beneficial owners if it is one of the following:

- Corporation (both C-Corp and S-Corp companies)

- Limited liability company (LLC)

- Company otherwise created in the United States by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe

- A foreign company registered to do business in any U.S. state or Indian tribe by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe

Your company doesn’t need to file BOI if it qualifies for an exception. A full list of exemptions is listed on the FinCEN website. Notable exemptions include:

- Some financial institutes, such as banks and credit unions

- Large, public operating companies (that are already subject to public reporting requirements under the Securities Exchange Act of 1934)

- Tax-exempt entities

- Sole proprietorships (unless it was created by filing a document with a secretary of state or similar office)

If you think you might qualify for an exemption but aren’t sure, the FinCEN provides a qualification checklist in Section 1.2 of the Small Compliance Guide.

When Do I Need to File?

FinCEN began accepting BOI on January 1, 2024. Any business that must comply can apply today. Existing businesses have until the end of 2024 to file. Newly created businesses must file within 30-90 calendar days after receiving actual or public notice that its creation or registration is effective.

BOI Filing Deadlines

- January 1, 2025: Companies created or registered to do business before January 1, 2024

- Within 90 Calendar Days of Registration Effective Date: Companies created in 2024

- Within 30 Calendar Days of Registration Effective Date: Companies created in 2025

Related: Add These Important Tax Deadlines to Your Calendar

What Do I Need to File?

To file BOI, you need information about the company and each beneficial owner.

- Each company is required to share its business name, tax ID, and address.

- Each beneficial owner is required to provide their name, address, identifying document (Passport or ID) information, and a photo of the identifying document. After providing personal information, each beneficial owner will be assigned a FinCEN ID.

How Much Does BOI Filing Cost?

BOI filing is free. If a company or website asks for financial information while completing your BOI, it may be a scam.

What’s a FinCEN ID?

A FinCEN ID is a unique identifying number issued to an individual by FinCEN. Beneficial owners can create a FinCEN ID here, or a FinCEN ID number will be created for them during the BOI filing process. To receive a FinCEN ID, each individual will be required to submit:

- Full name

- Address

- Identifying document (Passport or ID) information

- Photo of the identifying document

If you have multiple beneficial owners, it may be more secure to have each person create a FinCEN ID. Each owner can then provide their FinCEN ID (instead of their personal information) to the person filing the BOI on behalf of the company.

Related: 40+ Questions To Ask Your Business Accountant

How to File Beneficial Ownership Information

You can easily and quickly fill out a BOI online or by sending in an application.

- Determine if your company needs to file.

- Determine who your beneficial owners are.

- Collect information needed for each beneficial owner (list of personal information or a FinCEN ID).

- Visit the BOI E-Filing System (file online or print and send in an application).

- Enter information about the company.

- Enter information for Company Applicant(s) or their FinCEN ID (in some cases).

- Enter information for Beneficial Owner(s) or their FinCEN ID.

- File.

- Download and save confirmation.

What Happens If You Don’t File?

Failing to file BOI can lead to both civil and criminal charges. Both individuals and corporate entities can be held liable for willful violations.

According to the Corporate Transparency Act, a person who willfully violates the BOI reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues. A person who willfully violates the BOI reporting requirements may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000.

Related: 10 of the Most Common Bookkeeping Mistakes Small Businesses Make

Do I Need to Maintain BOI?

Once you submit your company’s BOI, you are not required to submit it again unless you make changes to beneficial owners within your company. Any updates must be submitted within 30 days.

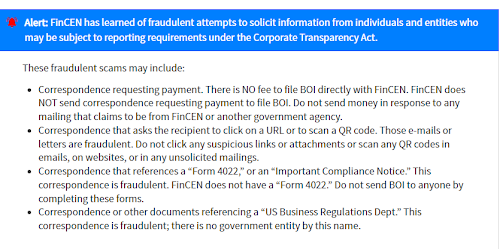

Look Out for BOI Scams

Be aware that there have been reports of scams and fraud related to BOI.

If you receive an email from a company asking for payment for BOI (BOI is free) or directing you to a link to file through a company, it could be fraudulent. FinCEN released the following alert to business owners.

What About the Court Challenges to the BOI?

What About the Court Challenges to the BOI?

Some organizations are fighting against the CTA act and calling BOI requirements unconstitutional. On March 1, 2024, a federal district court ruled in National Small Business United v. Yellen that the CTA Act is unconstitutional. The ruling says plaintiffs in the case are not required to comply with the law. But in most situations, businesses that meet the criteria set out by the CTA are still required to file. As the case is handled by the courts, most businesses should abide by the rules of the law and proceed to filing.

How Can I Keep My Business Compliant?

Beneficial Ownership Information is another step in running a compliant, secure, and stable company. If you need additional help with filing a BOI, check out:

Financial compliance and adherence to rules and regulations are incredibly important. It helps business owners avoid fines and fees, while also adding to the value and health of your business.

If you are struggling to keep your financial records up with changing laws and regulations, let’s talk. Our team of financial experts and professional bookkeepers can get your books and taxes in order so your business is always operating within accurate and compliant financial frameworks.

CFO2U is offering stress-free BOI filing. Work with us to get your documents filed correctly and on time. Learn more about our BOI filing support.

- Which Tax Classification Is Right For Your Small Business? - June 3, 2025

- 6 Expensive QuickBooks Mistakes You Might Be Making - April 27, 2025

- You Started a Business. Here’s What You Need to Know About Taxes - February 28, 2025