We’ve been hard at work over the past few months, and we’re excited to announce a big change. CFO Solutions has rebranded as CFO2U!

Introducing CFO2U

CFO2U represents a modern, new approach to our brand and offerings. Evolving with the changing needs of business owners, our updates allow us to better support small businesses across the country.

Our goals haven’t changed. As with CFO Solutions, CFO2U is still committed to helping small businesses decrease stress and accelerate success and growth.

What has changed is our approach.

Our new positioning allows us to support businesses who need it most — new and growing businesses that don’t have professional financial systems.

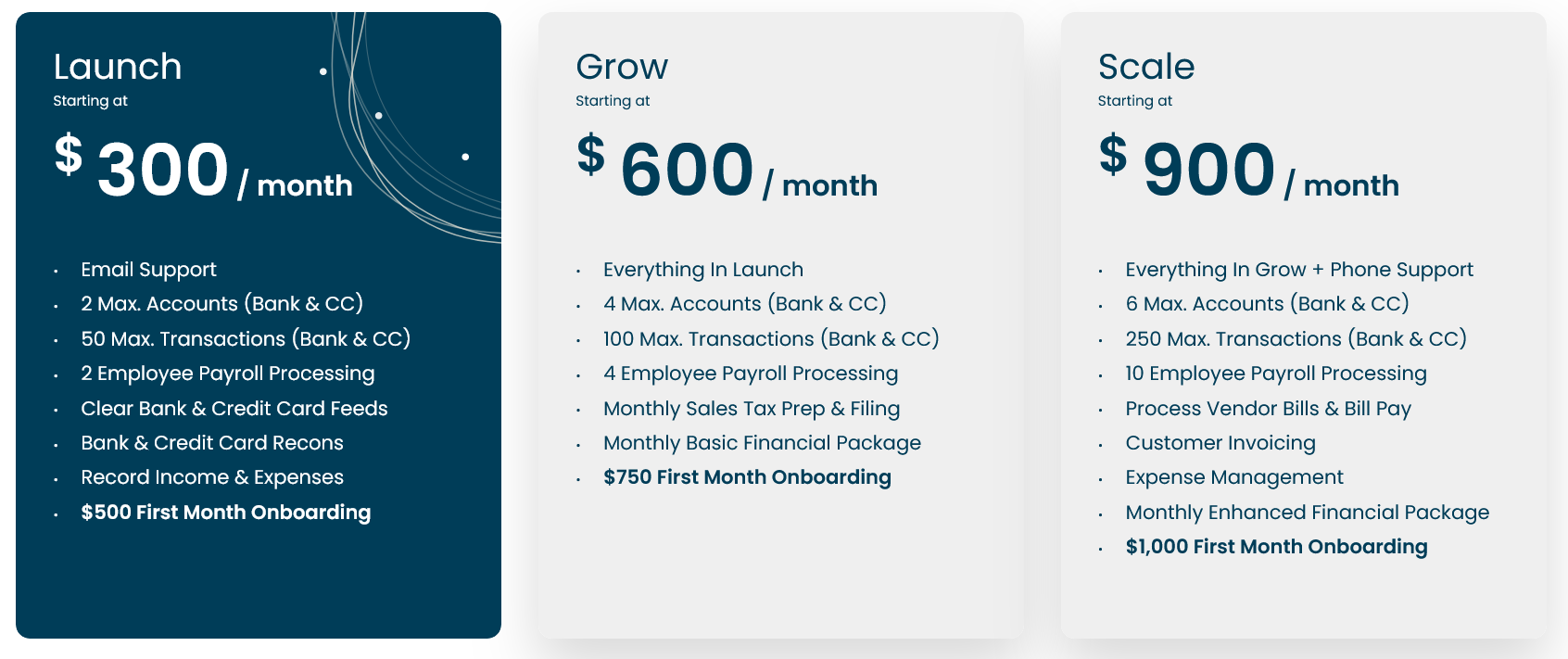

We’re excited to offer a new variety of cloud-based, monthly bookkeeping packages.

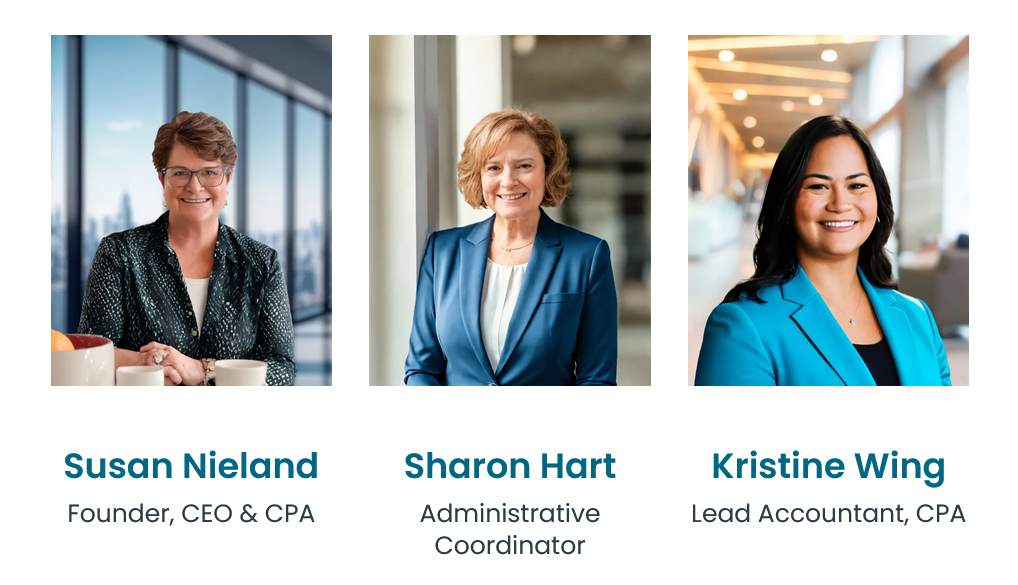

“Business owners need timely and accurate financial data to drive business decisions, yet they often settle for less, much less. They make key business decisions based on gut reactions and little or no financial data. They are driving blind with their tanks running dangerously near empty, and this is a huge problem,” says CFO2U Founder and CEO, Susan Nieland.

“Good bookkeeping is the foundation of all great businesses. If a business doesn’t have good books, they can’t find more growth and success.,” Susan says.

Bookkeeping Has Never Been Easier

Too many business owners find themselves in the same difficult position. They reach a point where there is too much to do, and the stakes are too high.

- They have outdated books and piles of unentered receipts and invoices.

- They don’t know how much money is in the bank today — or will be tomorrow.

- They are concerned and confused about complicated tax guidelines.

- They stay up at night with financial anxieties and fears of unexpected tax bills.

- Their business is stuck and stagnant.

This is where CFO2U comes in.

CFO2U now offers a variety of monthly cloud-based bookkeeping packages that give businesses the accurate financial records and insights needed to decrease stress and accelerate success and growth. With CFO2U, a dedicated team collaborates with business owners to understand their business, bring existing books up-to-date, and handle all aspects of monthly bookkeeping.

- Customized Solutions: We don’t offer one-size-fits-all services. Our approach is fully customized to meet the specific needs of your industry and business, ensuring you get the most relevant and effective financial strategies.

- Certified Experts: Our team holds certifications in key industry software, demonstrating our commitment to excellence and our ability to leverage the latest technology to your advantage.

- Cloud-Based: We are committed to providing our clients with cutting-edge, cloud-based solutions to streamline bookkeeping processes. By harnessing the power of technology and integrating it into our services, we enhance efficiency, accuracy, and overall client satisfaction. We utilize QuickBooks, Bill, and Gusto to meet the diverse bookkeeping needs of our clients.

Our customized onboarding services are designed to meet the unique needs of the business. Typically, this involves a one-hour video conference where our team of experienced bookkeepers will gain an in-depth understanding of your company’s operations to create a tailored bookkeeping strategy.

Our monthly bookkeeping packages start at just $300/month, making it an affordable option for new and growing businesses.

Our new focus on bookkeeping has not eliminated our other financial services. We are still offering tax services and outsourced CFO solutions. These services are now supported by the expert financial reports made possible by high-quality bookkeeping.

Our new focus on bookkeeping has not eliminated our other financial services. We are still offering tax services and outsourced CFO solutions. These services are now supported by the expert financial reports made possible by high-quality bookkeeping.

- Tax Services: Good books make tax time a breeze. Our tax experts can use your books to quickly file an accurate, stress-free tax return.

- Fractional CFO: Accurate insights can accelerate your growth and profitability. Clients can access monthly or quarterly strategy sessions to analyze records with an expert CFO.

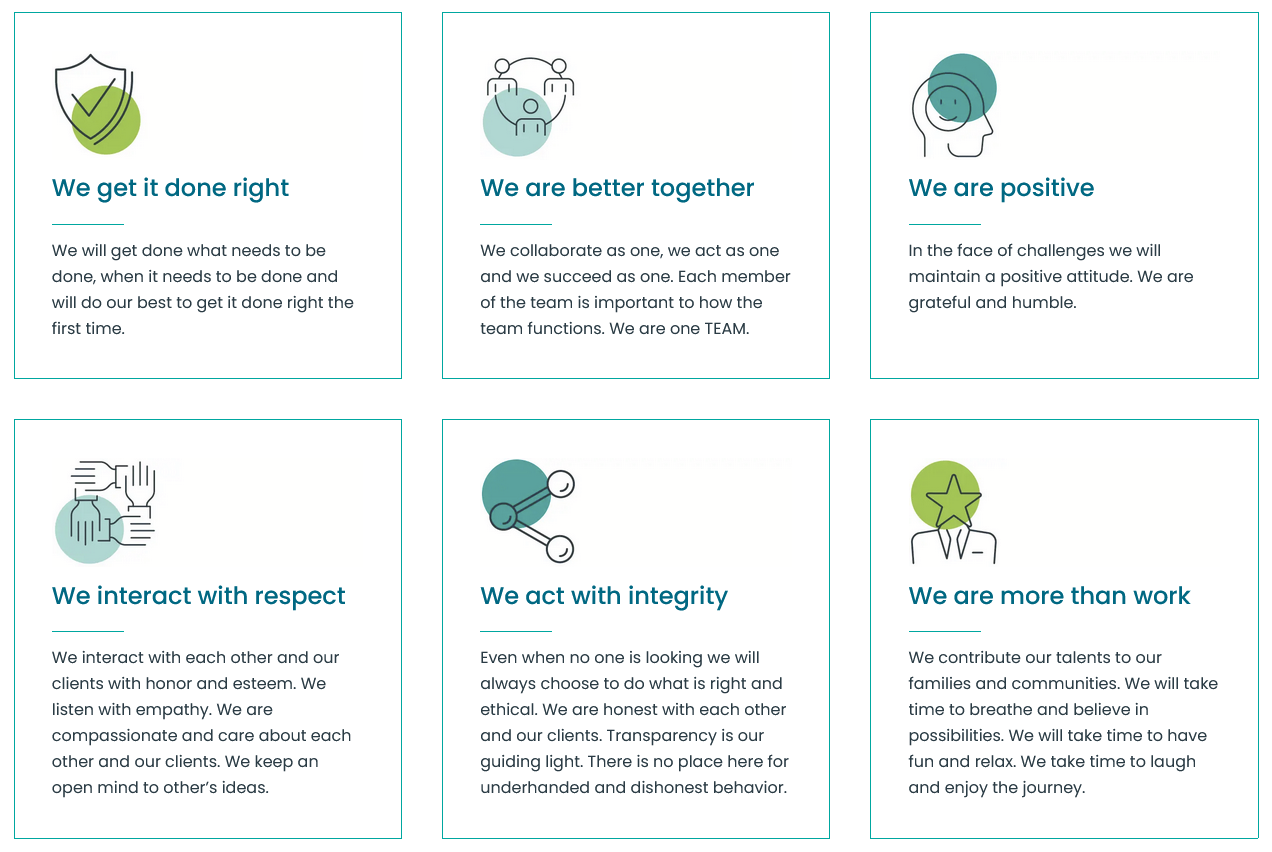

Staying True to Our Mission and Values

CFO2U’s founder and CEO, Susan Nieland started CFO Solutions over a decade ago with the mission to support business owners and entrepreneurs.

“It is my passion and life’s work to serve small business owners in their quest for success,” says Susan.

“Small businesses drive the American economy. Small business owners and entrepreneurs risk it all to bring their passion and vision to life. At CFO2U, we take the financial burden off the shoulders of small business owners, freeing up their time to run their business and providing them with the critical financial data they need to make informed decisions,” says Susan.

CFO2U is a woman and veteran-owned business committed to a set of core values.

CFO2U is a team of trusted financial advisors who make it our business to help you succeed at your business.

CFO2U is a team of trusted financial advisors who make it our business to help you succeed at your business.

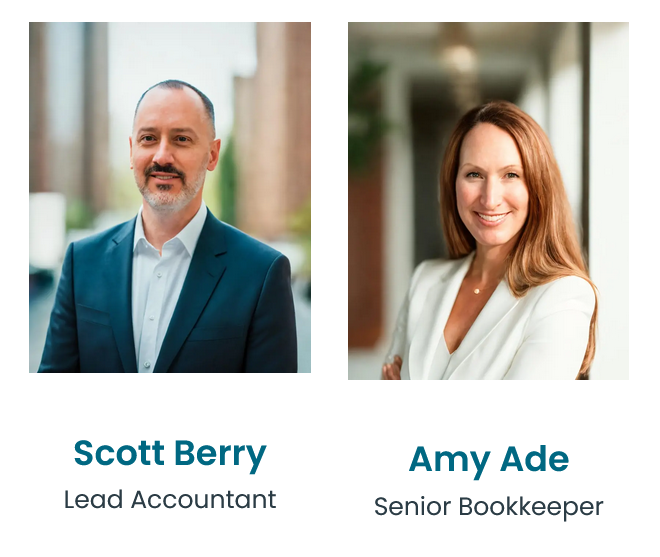

We’re a group of CPAs, accountants, and bookkeepers who are passionate about making our clients’ lives easier and their businesses more successful.

With CFO2U, you don’t sign up with a nameless bookkeeping vendor. You sign up with a business partner. We take time to get to know you and your goals, vision, and struggles to become a true extension of your business.

What Does the Change Mean for Current Clients?

What Does the Change Mean for Current Clients?

To our current clients, our rebrand will not impact your current projects or programs. We will continue to offer the same high-quality services you are used to. The only change is our new look and more defined offering of cloud-based bookkeeping solutions.

If you are a current client who is not engaging us for monthly bookkeeping, we’d love to extend this new service package to you. We’re offering a discount for all current tax clients.

Existing clients get 30% OFF your first three months of bookkeeping if you sign on before 7/30/24*.

*Discount applies only to 12-month contracts.

End Your Bookkeeping Headaches Once and For All

We are excited to go on this next journey of CFO2U with you!

If you are interested in learning more about our brand update or if you want to see how monthly bookkeeping packages can support your business, let’s talk.

Schedule a free discovery call with our team today.